PRC In the News

Bloomberg Law: AT&T’s Athene Pension Transfers Called Too Risky by Rights Group

“AT&T Inc. retirees challenging a transaction that shifted responsibility for funding nearly 100,000 pensions to an insurance company received support from the Pension Rights Center, which argued the move fell short of legal standards.”

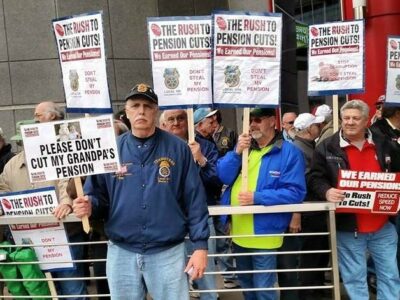

NPR: At the heart of the Boeing strike, an emotional fight over a lost pension plan

“There’s now a real recognition that workers want both good wages and good pensions,” said Karen Friedman, the executive director of the Pension Rights Center. “There’s a growing appetite for secure pensions, and I think we’re going to see more of it, honestly.”

Bloomberg Law: Pending DOL Report to Consider Pension Risk Transfer Changes

“We look forward to seeing the report, which we very much hope will include PRC’s recommendations to strengthen protections for workers and retirees when companies transfer their pension liabilities to insurance companies,” said Karen Friedman, PRC’s executive director. “Plan participants lose a lot in these transactions—including valuable [Pension Benefit Guaranty Corporation] insurance and other ERISA […]

Bloomberg Law: Athene-Linked Pension Cases Strike at Need for New DOL Guidance

Annuity-only providers such as Athene may be uniquely prone to risks, because they lack the asset diversification individual life insurers enjoy, said Norman Stein, senior policy counsel at the Pension Rights Center, which advocates for the return of more traditional defined-benefit pensions and opposes pension risk transfers.

Bloomberg Law: AT&T, Lockheed Suits Mark First Real Test for Pension Transfers

Labor Department guidance requires employers seek out the “safest available annuity,” Norman Stein, senior policy counsel for the Pension Rights Center, said. That standard may not be satisfied if employers opt to work with an insurance company facing significant criticism instead of one that’s universally respected, he said.

ASPPA: Recordkeeping in the Electronic Age

Recordkeeping today is not your grandfather’s recordkeeping. Maybe not even your older sibling’s. So guidance and education from the Department of Labor (DOL) would be helpful in adjusting to the changes that have taken place, concludes a recently released report.

InvestmentNews: Companies transferred billions in pension assets to annuities. Here come the lawsuits

If the lawsuits progress, there’s a lot that observers might learn about how companies solicit and evaluate bids, said Norman Stein, senior policy counsel and acting legal director at the Pension Rights Center.