How Well-Funded is Your Pension Plan?

Thanks to the Pension Protection Act of 2006, people covered by a traditional defined-benefit pension plan should now receive a pension funding notice every year, which gives workers an idea of how well-funded their plan is. However, if a funding notice is not available, it is possible to get a rough idea of the financial health of a plan by checking its Form 5500.

Private pension plans are required to file a financial report called a Form 5500 every year with the federal government. The Form 5500 provides information regarding the plan’s financial condition, investments, and operations.

If you are a participant in a private pension plan, you have the legal right to request the most recent Form 5500 from your plan administrator. Participants can also find a less recent copy of the Form 5500 on a web site called FreeERISA.com.

Once you’ve gotten the Form 5500, follow these steps to determine the funded status of your plan:

- Look for the form’s “Schedule B — Actuarial Information.”

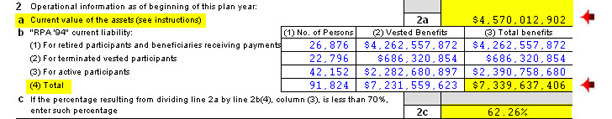

- Find line 2(a), which is labeled Current Value of the Assets. This column notes the total value of assets owned by the pension plan.

- Find line 2b(4), the total benefits column. This column shows the total amount the plan owes in benefits.

If the amount in line 2b(4) is less than the amount in line 2(a), your plan is overfunded. If the amount in line 2b(4) is more than the amount in line 2(a), your plan is underfunded.

< Back