Multiemployer Pensions Highlights:

The Latest on Multiemployer Pensions:

ASPPA: Recordkeeping in the Electronic Age

Recordkeeping today is not your grandfather’s recordkeeping. Maybe not even your older sibling’s. So guidance and education from the Department of Labor (DOL) would be helpful in adjusting to the changes that have taken place, concludes a recently released report.

Pension Rescue Law Providing Critical Assistance to Growing List of Plans

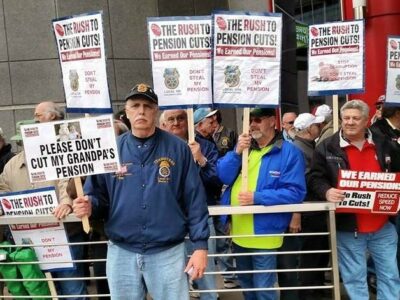

By David Brandolph The Butch Lewis Emergency Pension Plan Relief Act of 2021 (BLA) continues to provide an important lifeline to financially challenged multiemployer pension plans, and in turn, has already brought monetary and mental stress relief to hundreds of thousands of retiree-plan-members, their spouses, families and their communities. As of October 27, the Pension […]

Bloomberg Law: UAW Aims to Restore Retiree Benefits Given Up in 2008 Crisis

At the center of a historic UAW strike against all three major US automakers is an effort against long odds to reclaim retirement benefits workers conceded decades ago as manufacturers teetered on the brink of collapse. United Auto Worker union activists say they want back the guaranteed lifetime pension payments and retiree medical care they […]

Butch Lewis Act saves Central States Pension Fund

FOR IMMEDIATE RELEASE The Pension Rights Center and thousands of retired truck drivers, warehouse workers and spouses across the country are celebrating the approval of an infusion of funds that will keep the Central States Pension Fund going strong for decades to come. The White House announced today that the Pension Benefit Guaranty Corporation (PBGC) […]